Economic trends support stocks

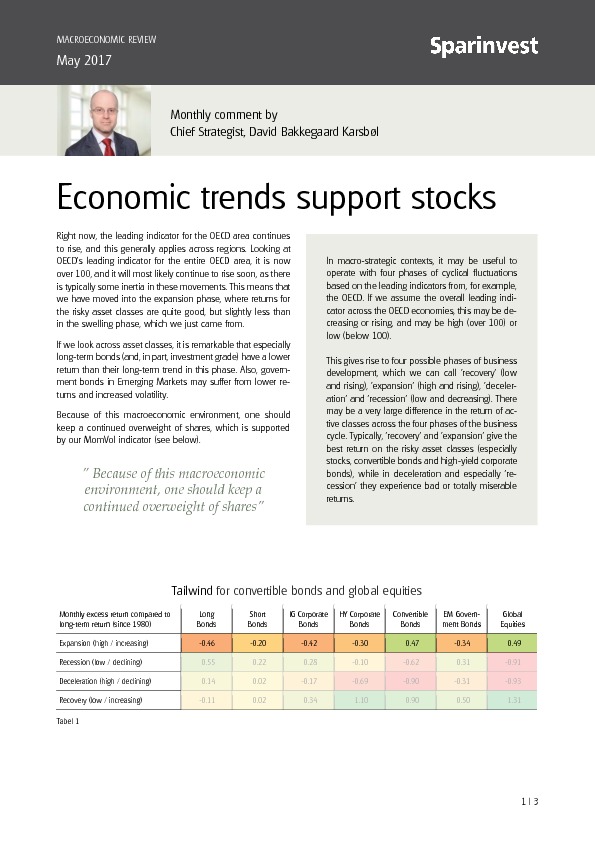

Right now, the leading indicator for the OECD area continues to rise, and this generally applies across regions. Looking at OECD's leading indicator for the entire OECD area, it is now over 100, and it will most likely continue to rise soon, as there is typically some inertia in these movements. This means that we have moved into the expansion phase, where returns for the risky asset classes are quite good, but slightly less than in the swelling phase, which we just came from.

If we look across asset classes, it is remarkable that especially long-term bonds (and, in part, investment grade) have a lower return than their long-term trend in this phase. Also, government bonds in Emerging Markets may suffer from lower re- turns and increased volatility.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.