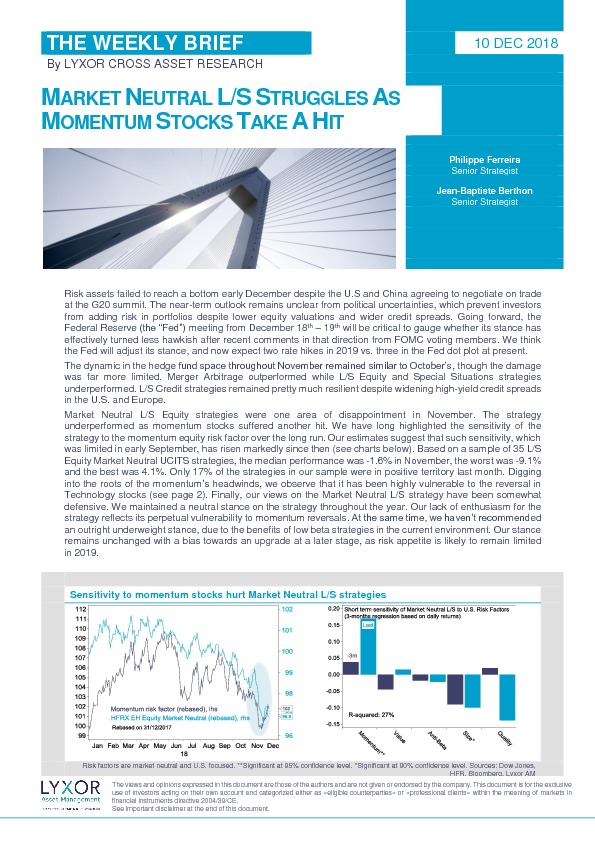

Market neutral L/S struggles as momentum stocks take a hit

Risk assets failed to reach a bottom early December despite the U.S and China agreeing to negotiate on trade ar at the G20 summit. The near-term outlook remains unclear from political uncertainties, which prevent investors e from adding risk in portfolios despite lower equity valuations and wider credit spreads. Going forward, the Federal Reserve (the “Fed”) meeting from December 18th – 19th will be critical to gauge whether its stance has effectively turned less hawkish after recent comments in that direction from FOMC voting members. We think the Fed will adjust its stance, and now expect two rate hikes in 2019 vs. three in the Fed dot plot at present.

The dynamic in the hedge fund space throughout November remained similar to October’s, though the damage was far more limited. Merger Arbitrage outperformed while L/S Equity and Special Situations strategies underperformed. L/S Credit strategies remained pretty much resilient despite widening high-yield credit spreads in the U.S. and Europe.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.