Safe from harm?

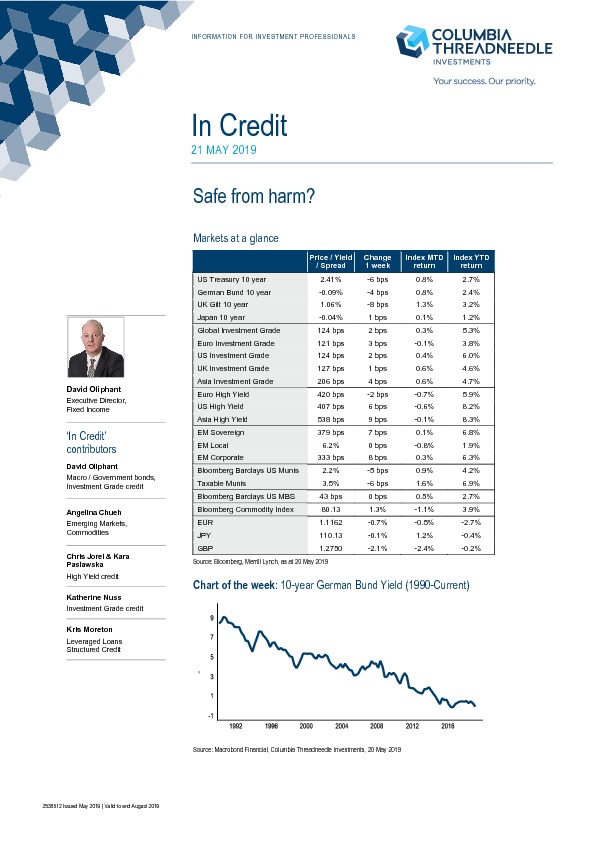

As such, demand for “risk-free” assets such as core government bonds has risen against a background of heightened trade tensions (China) and increased geopolitical noise (Iran, Italy, Brexit and Saudi Arabia). Ten-year US government bond yields, which peaked at 3.25% in November 2018 have fallen to around 2.4%. Ten-year German bonds trade at a more extreme -0.1% – close to the lowest on record (see Chart of the Week). There has been a concurrent softening in expectations for interest rates. At the time of writing the market is expecting a cut in rates in the US by the end of the year and unchanged rates in Europe. It is more difficult to explain these changes in market levels from a fundamental economic perspective.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.