A Deeper Look into Financial Vulnerabilities

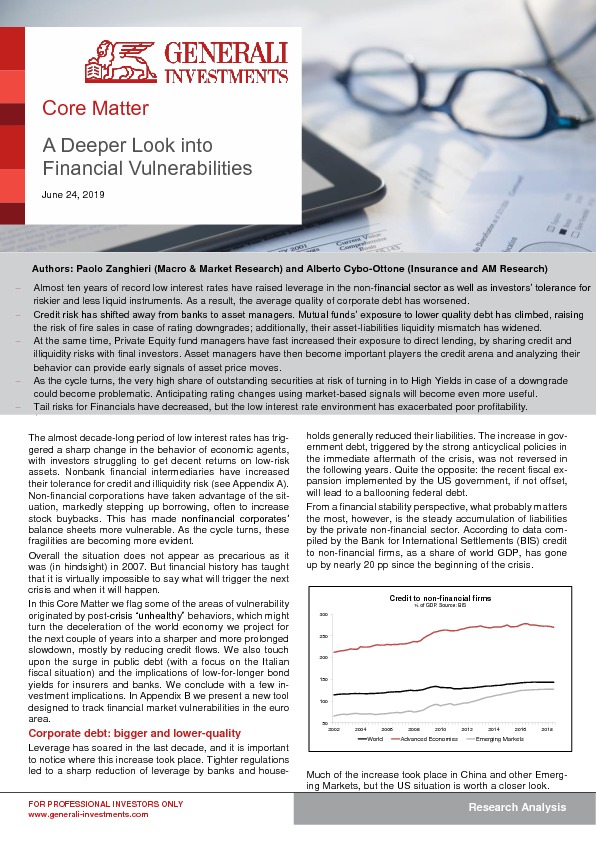

Almost ten years of record low interest rates have raised leverage in the non-financial sector as well as investors’ tolerance for riskier and less liquid instruments. As a result, the average quality of corporate debt has worsened. Credit risk has shifted away from banks to asset managers. Mutual funds’ exposure to lower quality debt has climbed, raising the risk of fire sales in case of rating downgrades; additionally, their asset-liabilities liquidity mismatch has widened.

At the same time, Private Equity fund managers have fast increased their exposure to direct lending, by sharing credit and illiquidity risks with final investors. Asset managers have then become important players the credit arena and analyzing their behavior can provide early signals of asset price moves.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.