European high yield credit update

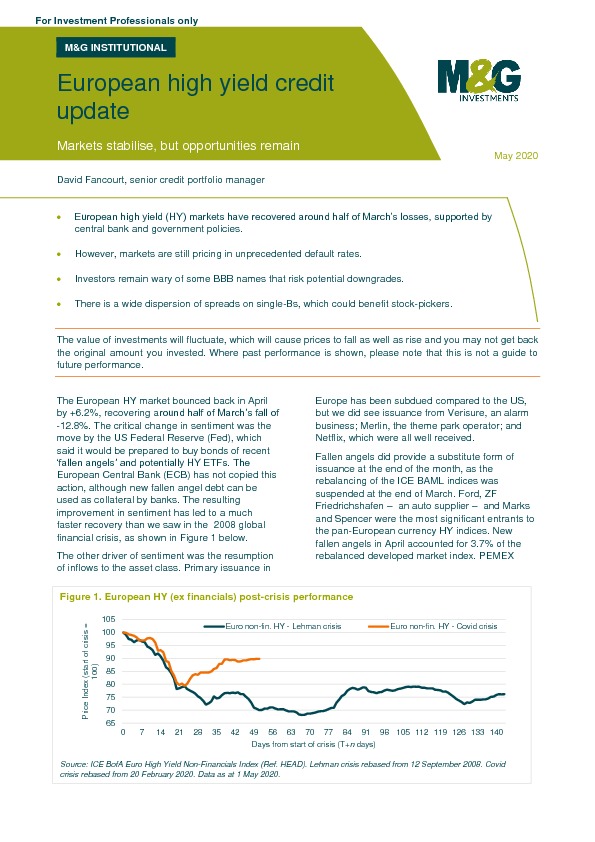

The European HY market bounced back in April by +6.2%, recovering around half of March’s fall of -12.8%. The critical change in sentiment was the move by the US Federal Reserve (Fed), which said it would be prepared to buy bonds of recent ‘fallen angels’ and potentially HY ETFs. The European Central Bank (ECB) has not copied this action, although new fallen angel debt can be used as collateral by banks.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.