Why would the fed cut?

Financial market expectations in 2019 have pivoted from a potential U.S. Federal Reserve rate hike to a rate cut. If rates are cut, what would be the cause – financial market pressures, an economic downturn, or maybe a change in policy?

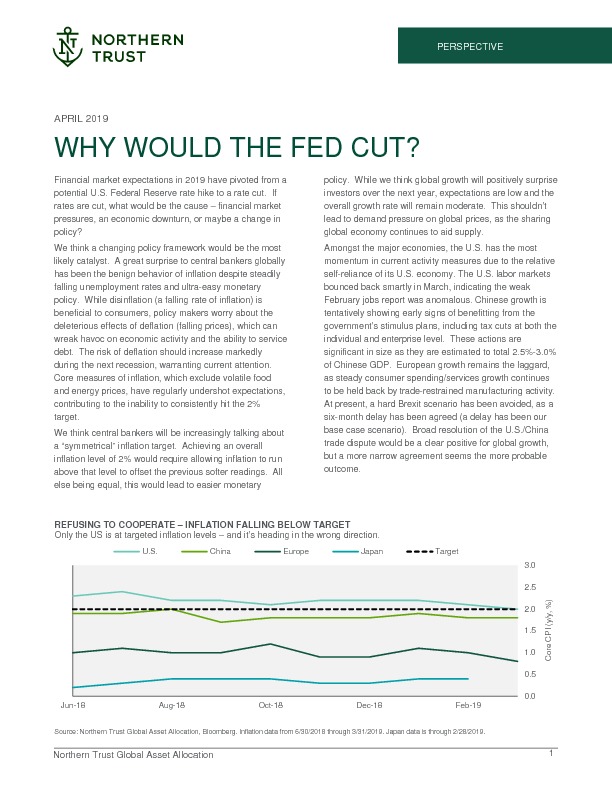

We think a changing policy framework would be the most likely catalyst. A great surprise to central bankers globally has been the benign behavior of inflation despite steadily falling unemployment rates and ultra-easy monetary policy. While disinflation (a falling rate of inflation) is beneficial to consumers, policy makers worry about the deleterious effects of deflation (falling prices), which can wreak havoc on economic activity and the ability to service debt. The risk of deflation should increase markedly during the next recession, warranting current attention. Core measures of inflation, which exclude volatile food and energy prices, have regularly undershot expectations, contributing to the inability to consistently hit the 2% target.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.