GIAM Macro & Market Research - Market Commentary

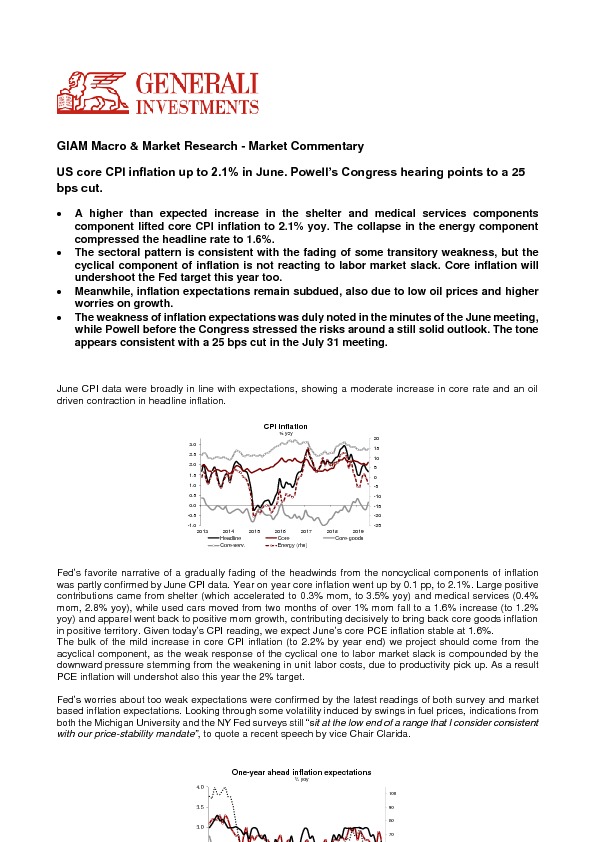

Fed’s favorite narrative of a gradually fading of the headwinds from the noncyclical components of inflation was partly confirmed by June CPI data. Year on year core inflation went up by 0.1 pp, to 2.1%. Large positive contributions came from shelter (which accelerated to 0.3% mom, to 3.5% yoy) and medical services (0.4% mom, 2.8% yoy), while used cars moved from two months of over 1% mom fall to a 1.6% increase (to 1.2% yoy) and apparel went back to positive mom growth, contributing decisively to bring back core goods inflation in positive territory. Given today’s CPI reading, we expect June’s core PCE inflation stable at 1.6%.

The bulk of the mild increase in core CPI inflation (to 2.2% by year end) we project should come from the acyclical component, as the weak response of the cyclical one to labor market slack is compounded by the downward pressure stemming from the weakening in unit labor costs, due to productivity pick up. As a result PCE inflation will undershot also this year the 2% target.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.