Which alternative strategy amid the trade confusion?

Renewed trade tensions sent markets into a tailspin at the end of last week. President Trump said he would place to an initial 10% tariff on $300bn of additional Chinese goods, effective on September 1st. Such tariffs would cover ols final goods, potentially hurting the last U.S. growth engine: consumers. The deadline leaves a narrow negotiation window in August, but it is hard to imagine how this can be sorted out.

The damage is done, and China vowed retaliation. To add to the confusion, President Trump later said he is “open to delaying or halting the 10% tariff”. Amid sluggish summer trading volumes and looming Brexit deadlines, investors will probably sell and go away before considering taking advantage of lower risk asset prices. Meanwhile, bond yields reached record lows in Europe and could test new lows in the coming weeks.

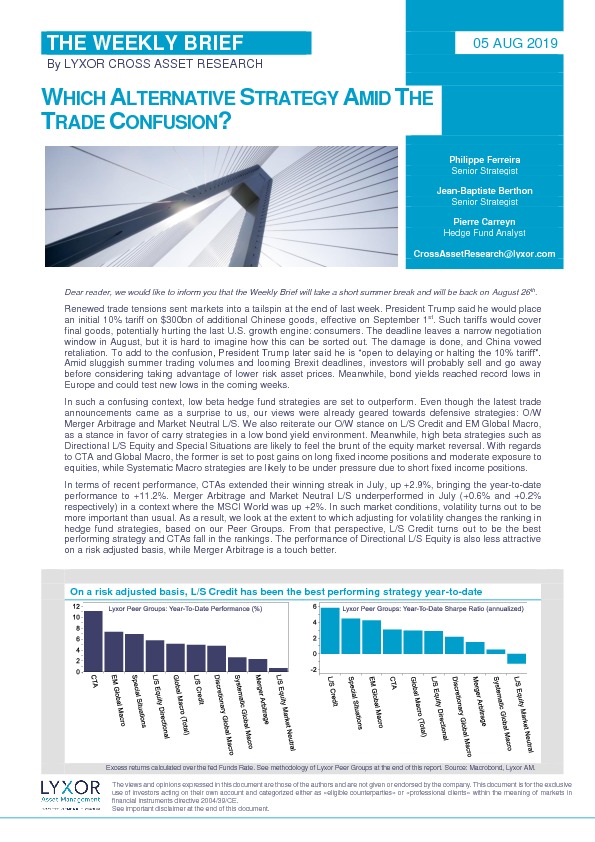

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.